From the accelerating evolution of anti-money laundering (AML) regulation to sweeping reforms to corporate transparency, 2025 has been a year of significant change for the legal sector. Firms have faced shifting expectations, more assertive supervision, and a growing need to demonstrate not only technical compliance but a culture of vigilance and accountability.

In our 2025 Year in Review, we reflect on the defining moments, regulatory developments and industry trends that shaped the last 12 months, and how Legal Eye has continued to support firms in navigating these challenges with clarity, confidence and practical guidance.

January

Legal Eye Academy revamped for 2025

We began the year by launching a fully refreshed Legal Eye Training Academy, designed to help firms meet rising SRA expectations around AML and wider compliance.

Key enhancements included a modernised interface, scheduled reporting, enhanced automation, instant certificate generation, and improved user controls giving firms greater flexibility in managing training. The upgrade strengthened our commitment to providing practical, sector-specific training that helped firms stay proactive and compliant across 2025.

February

Supporting private client teams through Estatesearch’s Live Webinar Series

In February, Legal Eye joined Estatesearch’s new live Webinar Series to help private client practitioners strengthen compliance and stay ahead of growing regulatory scrutiny.

Our MD, Paul Saunders, delivered a focused session on key risk areas for private client work, including AML expectations, TRS duties, sanctions compliance, and updated tax reporting obligations. The webinar also covered GDPR, cybersecurity risks, and the challenges of assessing capacity and supporting vulnerable clients. Attendees received practical steps to enhance risk management and embed robust compliance across their teams.

Promoting proactive firm-wide gap analysis

We also launched a time-limited £200 discount on our firm-wide risk and compliance gap analysis, encouraging firms to take a proactive, holistic view of their regulatory framework.

Our gap analysis reviews core documentation, office manuals, registers, plans, file reviews and wider compliance arrangements. Firms receive a detailed written report with recommended corrective actions, helping them address vulnerabilities before they lead to enforcement action.

Make sure you follow us on social media for potential offers throughout 2026.

March

Guiding firms through SRA audit readiness

In March, we published a comprehensive step-by-step guide to help firms prepare for the SRA’s increasingly frequent — and often unannounced — AML inspections.

The article highlighted the importance of up-to-date firm-wide risk assessments, independent AML audits, and tailored policies, controls and procedures. We also outlined key expectations around CDD, EDD, SoF/SoW checks, ongoing monitoring, and maintaining clear audit trails.

The guidance reinforced the need for regular staff training, robust SAR processes, and periodic gap analyses to identify vulnerabilities before the regulator does, and firms were encouraged to adopt a proactive, documented approach to AML compliance.

April

HM Treasury officially approved the Legal Sector Affinity Group’s (LSAG) updated AML guidance for the legal sector 2025

Key revisions to the guidance included new information regarding the Economic Crime Levy requirements for firms with a turnover exceeding £10.2m, supply chain risk assessment and the Register of Overseas Entities. Additional updates covered client verification procedures, third party source of funds, domestic politically exposed persons (PEPs), and new defences under The Economic Crime and Corporate Transparency Act 2023 (ECCTA) for de minimis amounts and mixed-property transactions.

Recognising excellence in the sector: Nimesh Ganatra judges the Probate Industry Awards 2025

Also this month, Legal Eye’s Head of Risk and Compliance, Nimesh Ganatra, served as a judge at the prestigious Probate Industry Awards 2025.

The Probies, now in their seventh year, celebrate innovation and excellence across the probate sector. Nimesh’s involvement underscored the vital role of risk and compliance expertise in maintaining high professional standards across the legal industry. Nimesh has also been invited back as a judge for 2026.

Mental health and compliance culture

We used April to spotlight the link between clear compliance procedures and wellbeing across the legal profession, ahead of Mental Health Awareness Week.

With LawCare reporting its busiest year on record, we highlighted how unclear systems, inconsistent expectations and poor documentation contribute to stress and anxiety within firms. The article emphasised that strong compliance frameworks support confidence, reduce uncertainty, and strengthen internal trust. Our message was simple: clarity in compliance isn’t just good regulation — it’s good for people, culture, and wellbeing.

May

Exploring the opportunities — and risks — of AI in legal practice

In May, we published the first two articles in our AI series, helping firms understand both the benefits and the governance requirements of emerging technologies.

Unlocking the power of AI

We examined how AI is already reshaping legal work, from automating due diligence and monitoring AML risks to predicting litigation outcomes and improving administrative efficiency. The article highlighted how AI can support — not replace — compliance professionals by freeing time for higher-level decision-making while maintaining SRA-required oversight. The piece reinforced the importance of implementing a robust AI policy to ensure ethical use, safeguard data, and mitigate regulatory, operational, and reputational risks.

Understanding the risks of AI

Our second article focused on the dangers of unregulated AI adoption, including hallucinated case law, confidentiality breaches, data protection risks, and IP concerns. We highlighted recent real-world examples — including false case citations and deepfake-enabled fraud — to illustrate the risks facing firms without proper controls.

June

What the regulators are saying about AI use in law firms

In June, we continued our AI education series by breaking down the positions of key UK regulators and what firms must do to adopt AI safely and compliantly.

- We explored the SRA’s outcome-focused approach, highlighting its message that innovation is welcome, but supervision, competence, and accountability remain essential.

- We reviewed the CLC’s long-standing engagement with AI and its expectation that firms prepare for increasing automation while maintaining transparency and consumer protection.

- We summarised CILEx’s tech-positive stance, emphasising efficiency gains paired with ethical responsibilities, particularly around data use and professional accountability.

Across all three regulators, the common theme was clear: firms must stay in control of AI use, justify decisions, and protect clients at every stage.

Best practice in complaints handling

We also published a comprehensive guide on compliant, effective complaints management under the Legal Ombudsman Scheme Rules.

The article set out how firms should develop clear, accessible complaints procedures, respond promptly, and communicate transparently throughout the process. Firms were reminded to maintain detailed records of each stage of the complaint, understand escalation rights, and adhere to LeO eligibility and time-limit rules. We also emphasised the value of regular staff training, trend monitoring and continuous improvement to strengthen both compliance and client service.

AML documentation review for conveyancing firms

June saw continued demand for our AML Document Review service, supporting firms under increasing regulatory scrutiny.

Through the service, our specialists review AML policies and procedures — including SoF, CDD, FWRA and matter risk assessments — against the requirements of the Money Laundering Regulations 2017. Firms then receive a detailed written report highlighting gaps and recommended corrective actions.

As our MD, Paul Saunders noted, good documentation is the foundation of AML compliance — and early intervention can prevent issues long before they reach a regulator.

July

Government publishes its response to the 2024 consultation on the Money Laundering Regulations (MLRs)

The consultation looked at changes that will be made to the MLRs to close loopholes, clarify requirements and ensure customer due diligence is targeted at high-risk activity. It covers four core themes:

- Making customer due diligence more proportionate and effective

- Strengthening system coordination

- Providing clarity on scope of the MLRs

- Reforming registration requirements for the Trust Registration Service.

These changes were later confirmed in a draft statutory instrument (SI), which is expected to be laid before Parliament in early 2026.

August

Enhanced AML training module launched on the Legal Eye Academy

In August, we unveiled a major upgrade to the Legal Eye Academy with the release of our enhanced 2025 Anti-Money Laundering (AML) training module. The updated module reflects the latest SRA guidance, ensuring firms remain aligned with the most current regulatory expectations.

September

New climate change training module launched for conveyancers

In September, we partnered with Groundsure to launch a comprehensive Climate Change and Conveyancing module through the Legal Eye Academy, helping firms meet the expectations set out in the Law Society’s 2025 Guidance Note.

The module covers advising on climate risks, understanding physical and transitional impacts, using climate risk searches effectively, evaluating flood risks, and recognising potential legal liabilities. This module adds a vital new dimension to our Academy’s training suite, supporting conveyancers as climate considerations become central to property due diligence.

Helping firms check their compliance in minutes

Compliance risk can creep in when you least expect it. In response, we introduced a new interactive compliance health checker, powered by Legal Eye’s Custom GPT, giving firms a quick way to identify potential gaps in their compliance framework.

After answering ten targeted questions, users receive an overall compliance score, tailored improvement suggestions, and links to relevant Legal Eye resources. The tool offers an accessible first step for firms wanting to benchmark their current position before undertaking deeper reviews.

Failure to Prevent Fraud comes into force

September also saw the introduction of the new Failure to Prevent Fraud offence under the Economic Crime and Corporate Transparency Act 2023, placing a duty on organisations to prevent fraud committed for their benefit.

We updated our AI policy for law firms

With AI tools becoming increasingly embedded in daily practice, we released an updated version of our AI policy to help firms adopt technology safely and compliantly.

Designed specifically for legal practices, our latest AI policy includes guidance on:

- Acceptable use of AI tools across the firm

- Human oversight requirements and supervisory responsibilities

- Data protection, confidentiality, and privilege safeguards

- Risk management protocols for errors, hallucinations, and bias

- Training and staff awareness guidance

- Alignment with SRA, CLC, CILEx and ICO expectation.

October

Government announces the FCA will take over AML supervision of all lawyers

The big news in October was the confirmation that AML supervision of law firms will move from the SRA to the FCA. As a result, firms face a new era of oversight, and potentially tougher scrutiny.

Legal Eye, whose parent company is regulated by the FCA, is keeping up to date with all the latest developments and is already preparing for how best to support our clients who will need to grapple with this mammoth change.

In the meantime, the SRA confirmed that their priorities for the coming year will include Regulation 19 – policies, controls and procedures. A major review of the use of client accounts and TPMAs also remain prominent in their planning for 2026.

The SRA publishes its 2024-25 AML Report

In October, the SRA’s latest AML Annual Report revealed that almost a third of inspected firms were not compliant with anti-money laundering requirements.

Key findings included:

- A 72% rise in ‘proactive engagements’ compared to the previous year

- 935 firms reviewed, with 270 referred for investigation

- Persistent weaknesses in client due diligence, risk assessments, and staff training

- Residential conveyancing identified as the highest-risk area.

Strengthening fraud-prevention controls under ECCTA

In October, we reminded firms of their obligations under the new Failure to Prevent Fraud offence, and emphasised the need for robust internal controls to defend against prosecution.

To defend against prosecution, we recommend that firms:

- Review the Home Office guidance (November 2024) and updates from the SRA, Law Society and CLC

- Audit existing risk management frameworks and fraud-related policies to ensure they reflect ECCTA requirements

- Incorporate “Failure to Prevent Fraud” sections into policies such as Financial Crime, AML, and Supplier Due Diligence

- Consider whether Client and Matter Risk Assessment forms and supplier due diligence need to be updated to reflect fraud vulnerabilities

- Extend contractual terms with outsourced providers to include fraud prevention obligations

- Conduct audits of internal and external procedures – including accounts, billing, client communications, supplier relationships and data controls – to identify potential exposure points

- Review staff screening and ongoing monitoring processes; reliance on trust alone will not be a defence

- Deliver training to ensure all staff understand the implications of the new offence and their responsibilities under the ECCTA.

Preparing for Companies House identity-verification reforms

We warned law firms to prepare for important changes coming into effect from Companies House. The changes – which came into play In November – form part of Companies House’s wider reforms to strengthen corporate transparency and tackle economic crime.

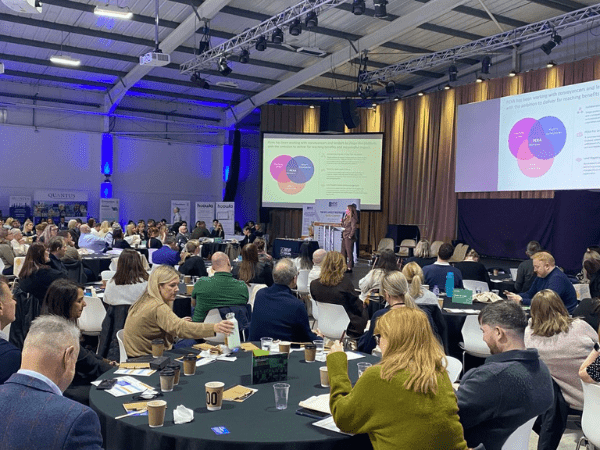

Sharing AML insights at the SRA Compliance Officers Conference

Our MD, Paul Saunders, took centre stage at this year’s Solicitors Regulation Authority (SRA) Compliance Officers Conference 2025, sharing practical insight into the evolving challenges of Anti-Money Laundering compliance.

Drawing on Legal Eye’s extensive experience supporting firms across the legal sector, Paul explored how firms can strengthen their AML frameworks by aligning policy with practice and fostering a culture of informed vigilance.

View slides and video recording from the day

November

Source of Funds and Source of Wealth – now under increased SRA scrutiny

The SRA’s latest thematic review highlighted a clear rise in regulatory focus on Source of Funds (SoF) and Source of Wealth (SoW) checks. The findings reveald significant weaknesses across the sector.

Following on from this, Legal Eye’s Alison Holt spoke at the Liverpool Law Society’s ‘Legal Finance in Focus: From Cashiering to Compliance’ event on 19 November 2025. Compliance specialist Alison took attendees through her session by reminding them that SoF is not a box-ticking exercise but a core safeguard against handling criminal property. Through case studies, practical examples and insights from the SRA’s latest thematic review, Alison outlined where firms are falling short and what good practice now looks like.

Companies House ID verification regime came into effect

In mid-November 2025, all existing directors and PSCs were required to complete an ID verification process before their company’s next confirmation statement can be filed. This is part of the reforms introduced under the Economic Crime and Corporate Transparency Act.

Legal Eye urges firms to strengthen AI governance after landmark High Court warning

We issued guidance following the Divisional Court’s judgment in Ayinde and Al-Haroun, which strongly criticised the use of generative AI where it led to fictitious case law, fake citations and misstatements being put before the court. The ruling made clear that leadership teams—managing partners, heads of chambers and senior managers—carry a heightened responsibility to ensure AI use is properly supervised, verified and understood across their organisations.

December

Reflecting on 2025 at our final Team Day of the year

In December, the Legal Eye team came together for our final Team Day of 2025 — a chance to pause, reflect, and celebrate a year marked by growth, collaboration, and continuous improvement. We looked back on the accomplishments across our consultancy, training, and policy services, shared success stories from across the business, and acknowledged the challenges we navigated together.

The session also gave us space to focus on what lies ahead. With major regulatory changes on the horizon and an expanding programme of support for law firms, it’s clear that 2026 will be an exciting and busy year for the whole team.

Looking forward to 2026

As we move into 2026, we want to thank our clients, partners and colleagues for their continued trust, collaboration and commitment to high standards throughout the year.

The regulatory landscape is set to evolve even further in the months ahead, and Legal Eye remains dedicated to helping firms navigate all their compliance challenges with clarity and confidence.

Whether through independent audits, policy development, tailored consultancy, or our expanding suite of online training modules, our focus for 2026 is simple: supporting firms to build resilient, future-ready compliance frameworks across every area of risk.

Our comprehensive list of services include:

- Risk & Compliance Firmwide Review

- AML Independent Audit

- Compliance Annual Support Packages

- File Reviews

- Complaints Handling

- Training (various modules): Live and exclusive or via our online Academy Platform

- AML Enhanced Bespoke Training – live and exclusive

- Accreditation Application and Support Service (CQS, Lexcel, WIQS)

- Legal Eye Quality Standard (LEQS)

- GDPR compliance

- Acquisition and Merger Compliance Audit

- Policy & Procedure Precedent Documents (click here for our online policy store).

Wishing all our clients, colleagues and partners a successful, resilient and well-prepared 2026.

If you’d like support strengthening your firm’s risk and compliance framework in the year ahead, contact Legal Eye at [email protected] or call 020 3051 2049.

(0)20 3051 2049

(0)20 3051 2049