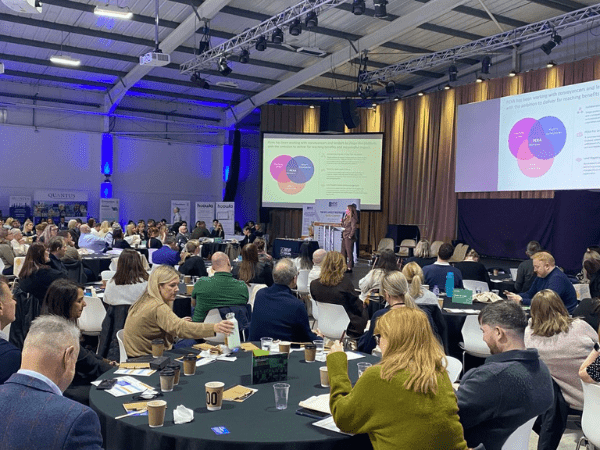

In 2021, the Solicitors Regulation Authority (SRA) officials visited an average of seven law firms per month as a part of the anti-money laundering (AML) crackdown. The year also saw the regulatory body commencing its promised enforcement action against legal entities that failed to comply with the regulations. Therefore, it shouldn’t come as a surprise that these policies were also the major focus of the annual SRA Compliance Officers Conference.

Owing to the ongoing pandemic, the 2021 regulatory compliance conference was held as a hybrid conference series where leading experts from the organisation and wider industry shared their insights about managing risk and compliance. They also discussed the importance of training and supervision and how law firms tend to have good policies, but rarely follow them.

In addition, the topic of SRA stepping up visits was also a major focus of the conference, along with the lack of proper conveyancing in the legal sector. The regulatory officers also talked about keeping the IT staff up-to-date on the latest systems to avoid user errors.

What Were The Main Failings Found By the SRA?

During its visits to more than 80 firms in 2021, the SRA determined that most entities in the legal industry have not updated their Firm-Wide Risk Assessments and Transactional Monitoring Programmes as frequently as required. The regulator also pointed out that firms need to regularly update their policies, procedures, and controls to ensure compliance with the AML regulations.

In addition, the SRA established that most entities in the legal industry have failed to ensure robust AML audits as per Regulation 21 of the Money Laundering Regulations 2017. Unlike financial audits, AML audits analyse whether a company has a proper anti-money laundering program in place and if it delivers the promised results.

The regulator pressed that firms need to pay more attention to their employee screening process and utilise various sources to prevent criminal infiltration. The SRA also discovered that most entities fail to comply with the regulatory requirements for customer due diligence (CDD) and do not carry out a matter or client risk assessments.

Recommendations for Managing Risk and Compliance

Here are some of the most noteworthy recommendations shared by the experts during the SRA Compliance Officers Conference 2021.

- Updating Policies, Controls, and Procedures: Firms should regularly review and update their policies, controls, and procedures.

Adopting a Risk-Based Approach: Solicitors and lawyers need to document and analyze the source of funds and source of wealth at the beginning of the legal transaction. - Monitoring of Transactions: Law firms must stress test their AML procedures and controls by reviewing each file individually.

- Conducting Risk Assessments: It is pertinent for firms to record and review every matter, particularly about conveyancing, taxes, and company work.

- Updating Firm Wide Risk Assessment: The FWRA must be updated to reflect the 2019 Amendment Regulations (Chapter 10)

- Introducing the Role of Deputy MLRO: It may not be legally required, but a Deputy MLRO can help share the load, ensure compliance with AML regulations, and support training initiatives.

- Secure PII: Despite the rising PII premiums, firms must secure and renew their professional indemnity insurance cover.

Apart from the recommendations mentioned above, the SRA also advised law firms to keep their training records up-to-date and document any suspicions. Solicitors and lawyers were also recommended to note how they reach major decisions for future review and ensure their policies are aligned with the latest regulatory guidelines to manage risk and compliance.

What Will SRA Focus On In 2022?

At the conference it was made clear by the SRA that they will have more visits in store for solicitors and law firms in 2022. The regulator will also pay more attention to the status of policies, controls, and procedures at the firm along with the quality of Firm Wide Risk Assessments and Customer Due Diligence.

Although the last year saw a rise in PII premiums, the SRA expects the legal sector to start renewing or acquiring professional indemnity insurance early. This is because insurance companies are highly interested in finding out how firms manage their risks and compliance.

(0)20 3051 2049

(0)20 3051 2049