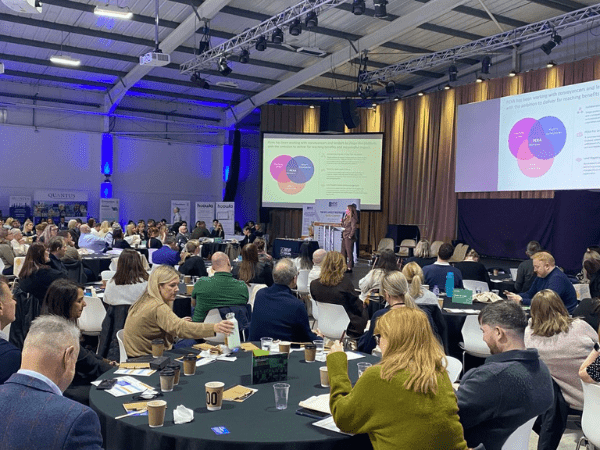

The Solicitors Regulation Authority (SRA) currently inspects around 500 law firms annually, combining desk-based and on-site reviews. While there have been encouraging developments in firm-wide compliance – with improved risk assessments, PCPs, and client due diligence – gaps remain. In a session at the recent SRA Compliance Officers conference, the SRA discussed what these breaches look like, and, in doing so, highlighted common risk areas within the legal sector.

Insufficient emphasis on AML controls and risk assessments

One of the standout issues flagged by the regulator is the insufficient priority given to establishing robust, compliant AML controls. Too often, firms underestimate the importance of these safeguards, leaving gaps that bad actors can exploit.

A well-designed AML framework isn’t just a regulatory checkbox – it’s the backbone of a firm’s defence against financial crime, crucial for maintaining security and client trust. The SRA has responded to these gaps by issuing warning notices, offering guidance, and providing templates to support firms in their compliance efforts.

Inadequate assessment of risk at both firm and client/matter level

While firm-wide compliance has improved, many firms still overlook the need for detailed client/matter-level risk assessments. Without these detailed checks, lawyers can miss vital red flags, leaving their firms vulnerable to criminal exploitation. Cutting corners on these assessments creates blind spots, significantly raising the risk of unwittingly facilitating money laundering. A holistic approach to risk assessment is needed to ensure regulatory compliance and safeguard the firm’s reputation.

Lax systems allowing unchecked transactions

Another recurring theme involves weak systems and processes that fail to flag risky or unusual transactions. In some cases, firms lack mechanisms to monitor key stages – such as the receipt of funds or moving forward in the transaction process. Inadequate checks make it easier for criminals to exploit the legal system, particularly in high-risk areas like conveyancing. By designing systems that actively monitor and verify each step in a transaction, firms can mitigate the risks and reduce the likelihood of AML breaches.

The need for supervision, training, and a compliance-driven culture

The SRA highlighted the importance of a compliance-driven culture. In short, compliance cannot be left to processes and systems alone; it requires consistent supervision, ongoing training, and a firm-wide culture that prioritises AML vigilance. All employees, from junior staff to senior management, must understand their role in preventing money laundering.

This underscores the importance of AML training programs that are not merely annual checkboxes but incorporate regular updates, real-world scenarios, and interactive learning. Training should also be backed by robust supervision to ensure compliance practices are embedded into day-to-day work.

Fraudulent schemes and dubious Investments

The SRA also identified fraud as an ongoing concern, including involvement in questionable investment schemes. Some firms inadvertently enable these schemes by failing to conduct rigorous client due diligence or by overlooking red flags. To mitigate the risk, firms should implement enhanced due diligence measures, particularly for high-risk clients or transactions. This includes scrutinising the legitimacy of investments and probing for any inconsistencies or unusual aspects in a client’s financial background.

Misuse of client accounts and suspicious fund transfers

Client account misuse was also highlighted, with funds sometimes being split and distributed to various parties without sufficient justification or oversight. This ‘layering’ tactic is a common money-laundering technique designed to obfuscate the origin of funds. When firms fail to monitor client accounts rigorously, they risk unwittingly aiding in these schemes. To address this, firms should implement strict policies governing client account usage and ensure regular audits. Transparency and tracking of funds are essential, as is the documentation of fund movements.

Building a resilient compliance framework

The SRA’s findings reveal where law firms are struggling to meet their AML obligations. In sharing these key themes, the regulator underscores the need for an integrated compliance framework that combines rigorous training, strong supervision, and a culture of vigilance.

For firms looking to strengthen their AML framework, Legal Eye offers expertly tailored support. From implementing comprehensive risk assessments to providing customised training and guidance, we ensure your firm stays compliant and prepared for regulatory scrutiny.

Contact Legal Eye today to learn how we can support your firm’s AML compliance needs. Email: [email protected] or call 020 3051 204.

(0)20 3051 2049

(0)20 3051 2049