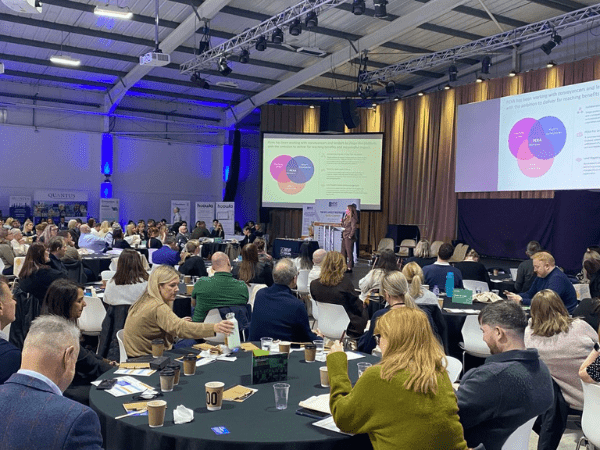

In November, Legal Eye attended the Solicitors Regulation Authority Compliance Officers Conference. Focusing on enhancing anti-money laundering (AML) compliance within legal practices, the event featured notable speakers such as Alexandra Jones, the SRA’s Director of AML. Recently appointed, Alexandra Jones joins the regulator as it ramps up enforcement action following AML breaches. Here’s what she had to say to delegates.

The evolving threat landscape

One critical insight shared during the conference was that money laundering schemes, regardless of complexity, often exploit standard legal and financial services processes. The profession must be vigilant to avoid inadvertently facilitating these schemes. The National Crime Agency (NCA) and the Financial Action Task Force (FATF) both report a growing threat from organised crime in the UK, underscoring the need for robust AML practices.

“The Financial Action Task Force Issued a pretty savage report of the UK in 2018. In 2022, they said we’d improved, but we were still only considered largely compliant with basic areas like customer due diligence, assessing risk and targeted financial sanctions related to terrorism.”

Alexandra Jones, Director of Anti-Money Laundering, Solicitors Regulation Authority

Effective AML training was highlighted as a frontline defence in this fight – helping staff to recognise red flags, improve awareness, and ensure compliance with the Money Laundering Regulations, the Proceeds of Crime Act, and the Terrorism Act. With staff potentially facing criminal prosecution if they get involved in money laundering or terrorist financing, employees simply must have the relevant knowledge and skills to identify risks and protect themselves and their firms.

The role of effective training in AML compliance

Practical AML training does more than meet regulatory requirements; it strengthens a firm’s entire compliance framework. Key benefits of quality AML training, as highlighted at the conference, include:

- Enhanced detection and prevention: Trained staff are more adept at spotting suspicious activities early, reducing a firm’s risk exposure.

- Robust compliance framework: Regular training keeps all employees aligned with the latest AML regulations and policies, creating a strong compliance culture.

- Improved client due diligence: Well-trained employees are better equipped to conduct thorough client verification, which is essential in preventing financial crime.

- Enhanced source of funds (SoF) spotting: Training leads to better fund scrutiny, with staff feeling confident in their ability to assess and verify the legitimacy of client funds.

- Swift response capabilities: Clear training on escalation procedures allows firms to respond quickly to suspected cases, ensuring a timely and appropriate reaction.

“Investment in comprehensive annual training will show that law firms can create a culture of vigilance and compliance. And that, in turn, will make it not only significantly more challenging for criminals to attempt to exploit your firms, but also substantially less appetising for them to even make the attempt.”

Alexandra Jones, Director of Anti-Money Laundering, Solicitors Regulation Authority

The current picture when it comes to AML training

Ms Jones described what the regulator is currently seeing when it comes to AML training. The key headlines are:

- Firms that maintain training records are much more likely to be compliant.

- Firms that provided effective training content were significantly more likely to be rated as compliant.

- Firms were more likely to be deemed compliant if recent annual training had been provided (within the last year).

- Where money laundering compliance officers had undertaken additional training, firms were around 50% more likely to be compliant.

But what does good versus bad look like when it comes to AML training?

Good AML training

Effective AML training should take a dynamic and tailored approach that meets each firm’s unique needs. According to the SRA, key indicators of good training include:

- Real-life examples and case studies: Training is most impactful when it connects theory to practice, enabling employees to recognise the signs of potential money laundering activities through relevant case studies.

- Ongoing learning: AML training shouldn’t be limited to an annual session. Continuous learning and periodic refreshers help keep AML issues in mind, reflecting the ongoing nature of AML risks.

- Flexibility in delivery: Different learning styles require varied training methods, such as workshops, e-learning modules, and team discussions. This ensures all team members are engaged and retain vital information.

- Department-specific training: Tailoring content to address specific risks helps staff better understand the red flags pertinent to their roles and responsibilities.

These elements foster a proactive, informed culture within firms, with staff equipped to comply and act swiftly and confidently when issues arise.

“But it’s not all terribly, terribly serious all of the time. We’ve also seen firms employ some creativity, taking a bit of a lighter touch approach. So we’ve seen AML lunch and learn sessions, we’ve seen quizzes and competitions used – and one firm particularly credited those with helping people to really interact in a decent way with their compliance team.

“We’ve also been encouraged by the continuous training method carried out by sole practitioners and these include attending AML webinars and conferences, as well as subscribing to dedicated AML updates to make sure they are on top of developments”

Alexandra Jones, Director of Anti-Money Laundering, Solicitors Regulation Authority

Warning signs of ineffective AML training

Jones also highlighted common pitfalls in AML training, which can leave firms vulnerable. Poor AML training practices identified included:

- Inadequate record-keeping: Missing or incomplete training records and not following up with those who’ve either missed or not completed the AML training in full.

- Over-reliance on generic training packages: Training not tailored to a firm’s unique clientele or risk profile may fail to prepare employees for real-world risks.

- Recycling outdated materials: Stagnant training that doesn’t adapt to new risks or changes within the firm’s client base fails to engage staff and undermines the training’s relevance.

By avoiding these pitfalls, firms can create a training program that is compliant and genuinely effective in safeguarding against money laundering.

SRA’s expectations for AML training compliance

During inspections, the SRA assesses a firm’s AML training program by looking at several key indicators. Firms should be ready to provide the regulator with:

- Comprehensive training materials: This includes tailored materials such as presentations, handouts, online content, and notes.

- Attendance records and training dates: Documentation of who attended and when, ensuring all employees receive the required training.

- Assessment results: Firms should maintain records of the evaluations or quizzes used to test employees’ understanding, including follow-up actions for those who may not have met the necessary standards.

In addition to these documentation standards, the SRA expects clear leadership and an emphasis on why AML training is critical – not just for compliance but also to protect the firm’s integrity and reputation.

The ROLE framework: A guide for AML training excellence

In her session, Jones introduced the ‘ROLE’ framework as a guide for AML training. The SRA expects firms to uphold this standard in their AML training programs. ROLE stands for:

- Relatable: AML training should be relevant and relatable to the role. Generic training packages will not always be fit for purpose.

- Ongoing: Given the evolving nature of money laundering techniques, training should be an ongoing endeavour rather than a one-time exercise.

- Leadership-led: Effective training is supported by firm leadership, emphasising its importance and encouraging active engagement from all employees.

- Engaging: Interactive training that uses case studies and incorporates a variety of learning methods keeps employees interested and invested in compliance.

What’s next?

So, what does the SRA want law firms to do? In addition to staying up to date with the SRA website and guidance, Jones also asked firms to have a really good look at the training material they are using and think about when it was last updated.

“It’s really simple: firms that have good training materials get good outcomes from inspections.”

Alexandra Jones, Director of Anti-Money Laundering, Solicitors Regulation Authority

She also warned about the need for robust reporting processes, stressing that, even with the best controls in the world, AML efforts will likely fail if staff don’t know how to report suspected economic crime.

Looking ahead: upcoming AML resources and events

The SRA is committed to supporting the legal profession in strengthening AML compliance. The conference concluded with announcements for upcoming webinars and training events. In 2025, the SRA’s annual thematic work will focus on the ‘Source of Funds’ requirement, aiming to further fortify compliance within the sector.

Strengthen your firm’s AML defences with expert training from Legal Eye

The SRA Compliance Officers Conference underscored that robust, engaging, and ongoing AML training is essential in safeguarding legal practices from the evolving risks of financial crime. With expert training support, law firms can ensure the tools and guidance necessary to build resilient, compliant, and trusted practices in an increasingly complex risk environment.

At Legal Eye, we offer a wide range of AML training solutions designed specifically for law firms. With a blend of digital learning and practical, scenario-based sessions – including enhanced masterclasses for AML professionals – we keep your firm compliant and secure.

Contact us to learn more about our AML training programmes today. Email: [email protected] or call 020 3051 204.

(0)20 3051 2049

(0)20 3051 2049