Did you know? The impact of money laundering on the UK annually is reported to be more than £100 billion!

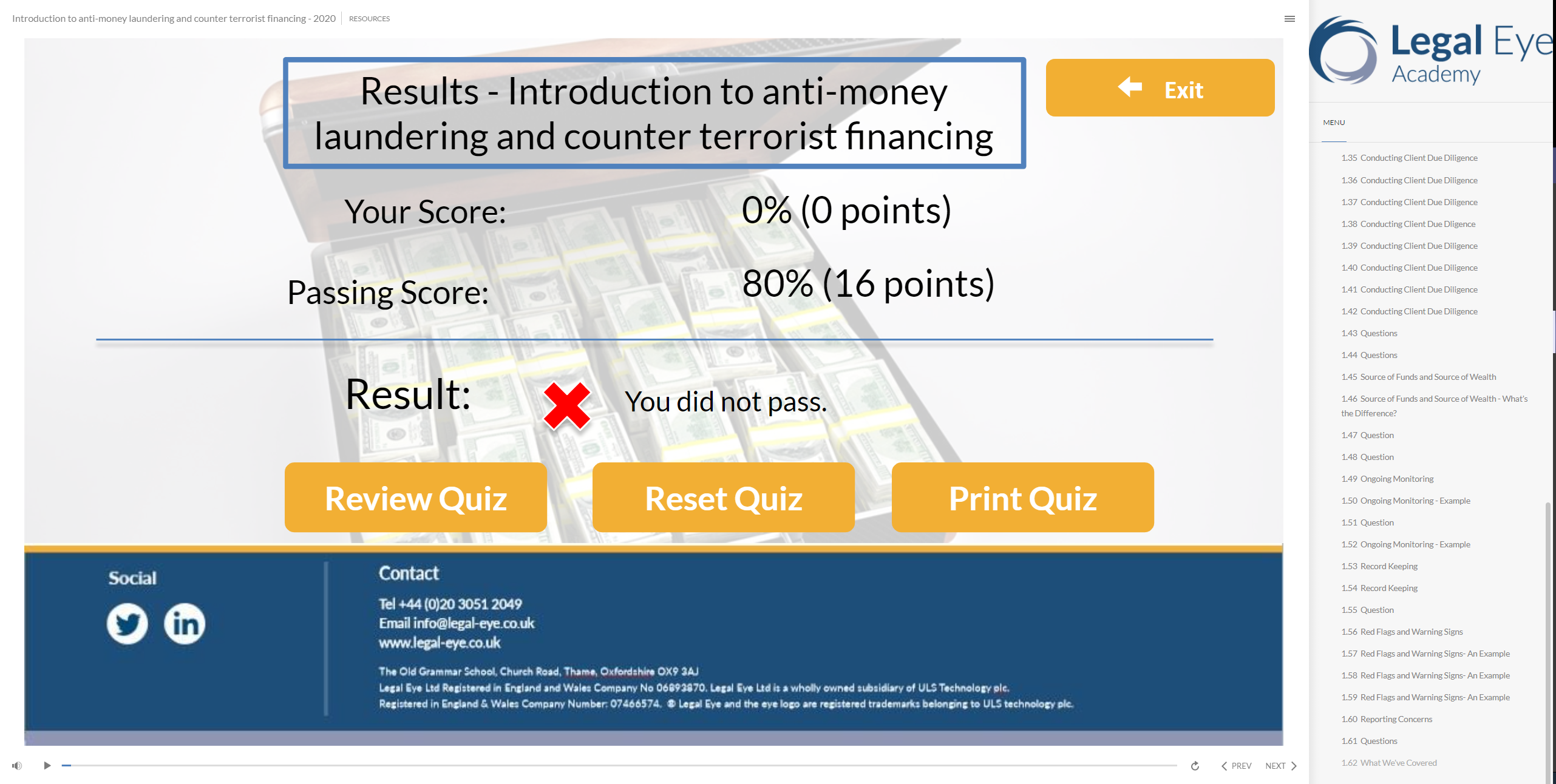

Staff training is a crucial requirement of the Money Laundering regulations as well as to protect your firm from falling victim to a money laundering scam.

Updated with the requirements of the 5th Money Laundering Directive, our ‘Introduction to anti-money laundering and counter-terrorist financing’ Academy module covers all you need to know, including:

- What is money laundering and terrorist financing?

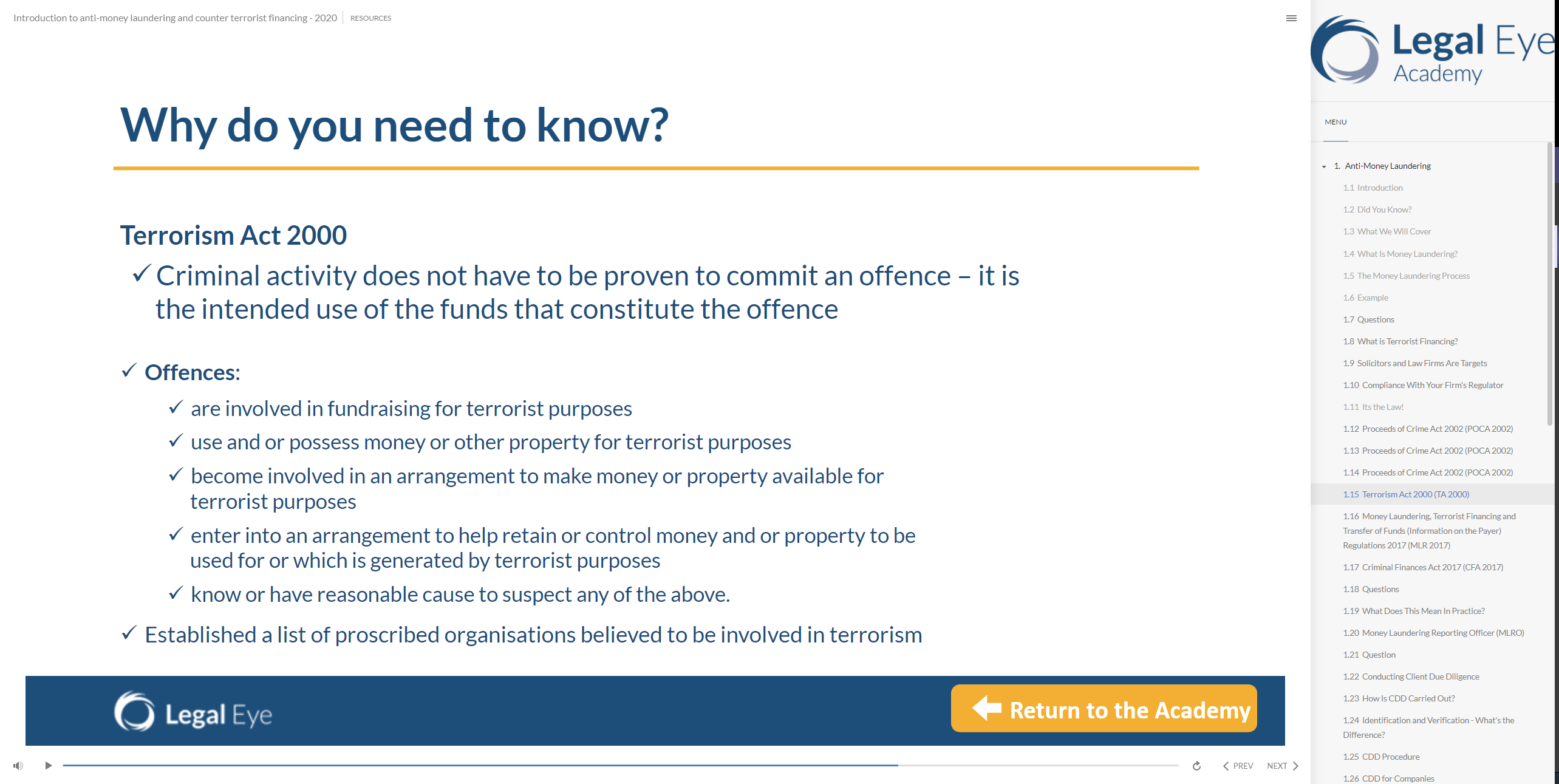

- Why do you need to know?

- What does this mean in practice?

- Your MLRO

- Conducting client due diligence

- Enhanced due diligence for high risk matters

- Source of funds and source of wealth

- Red flags and warning signs

- Reporting your concerns

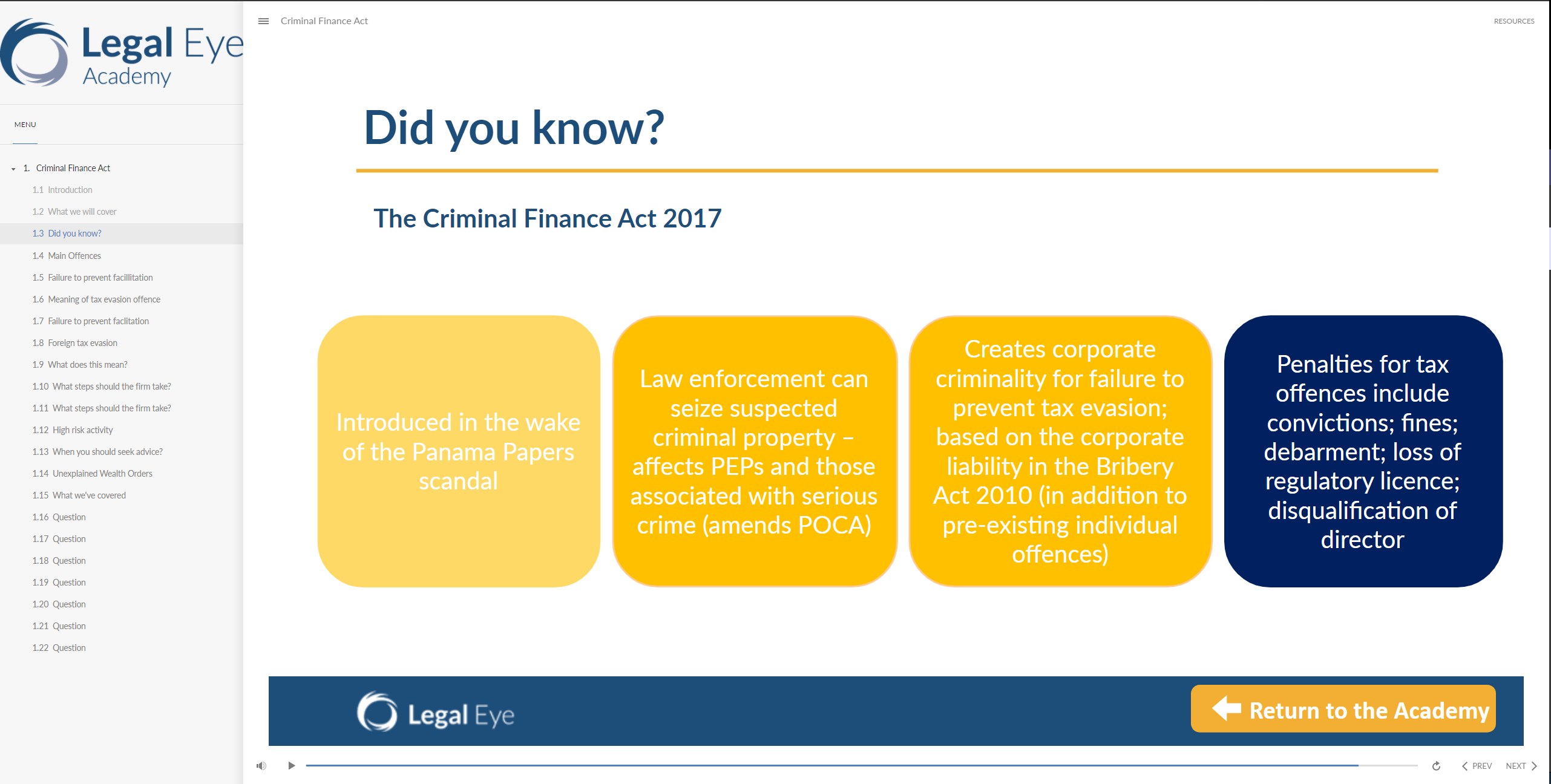

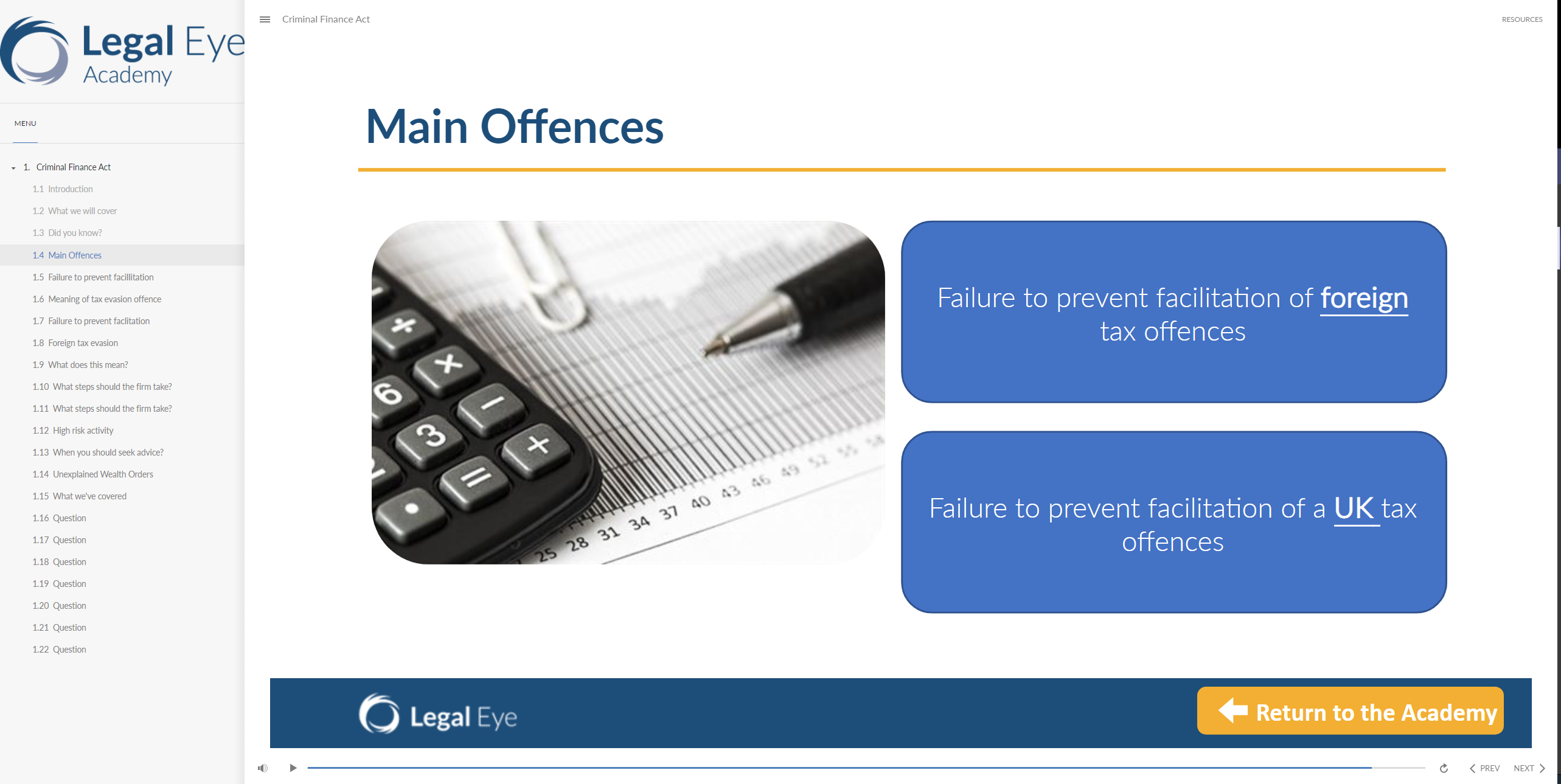

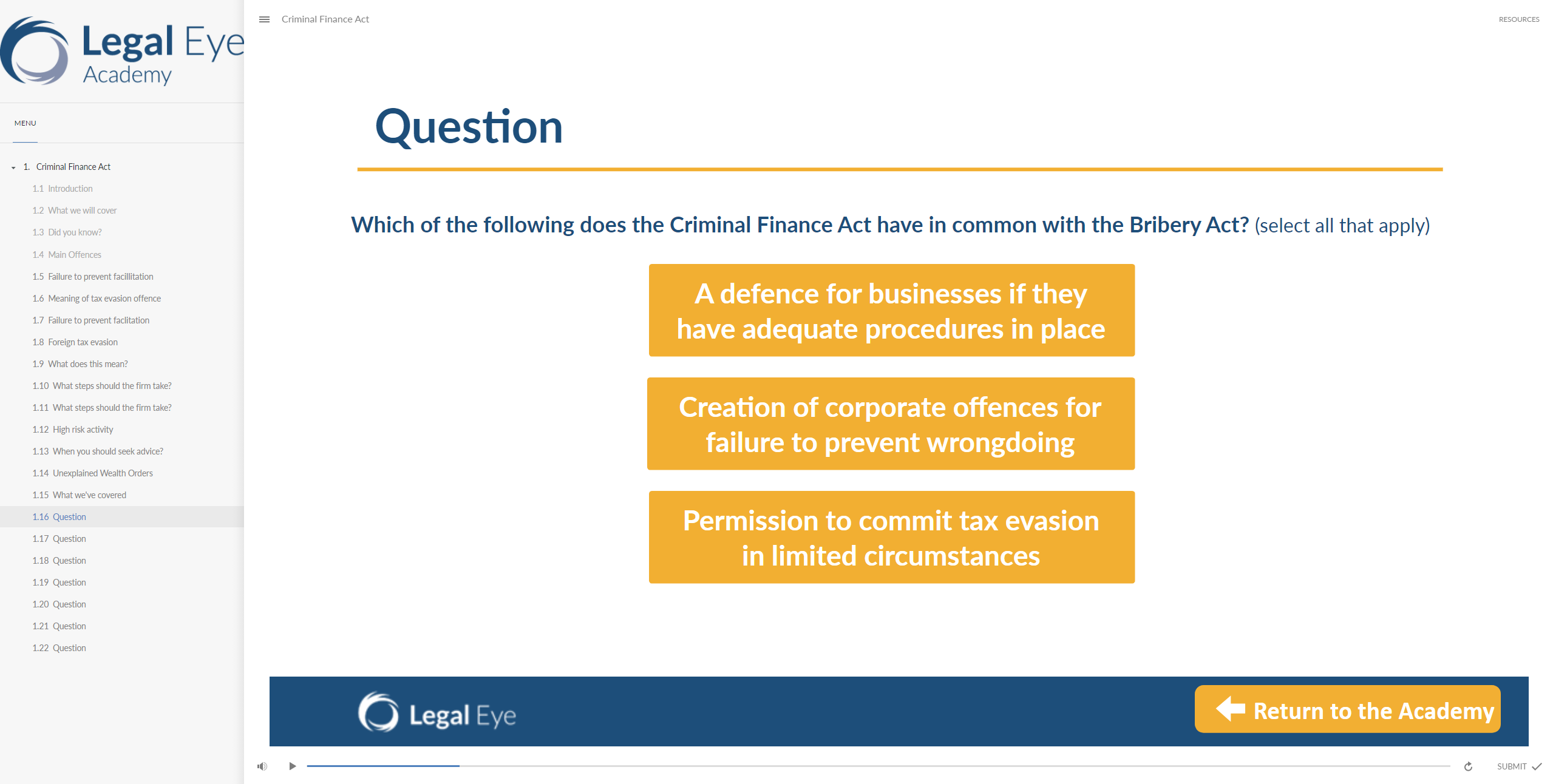

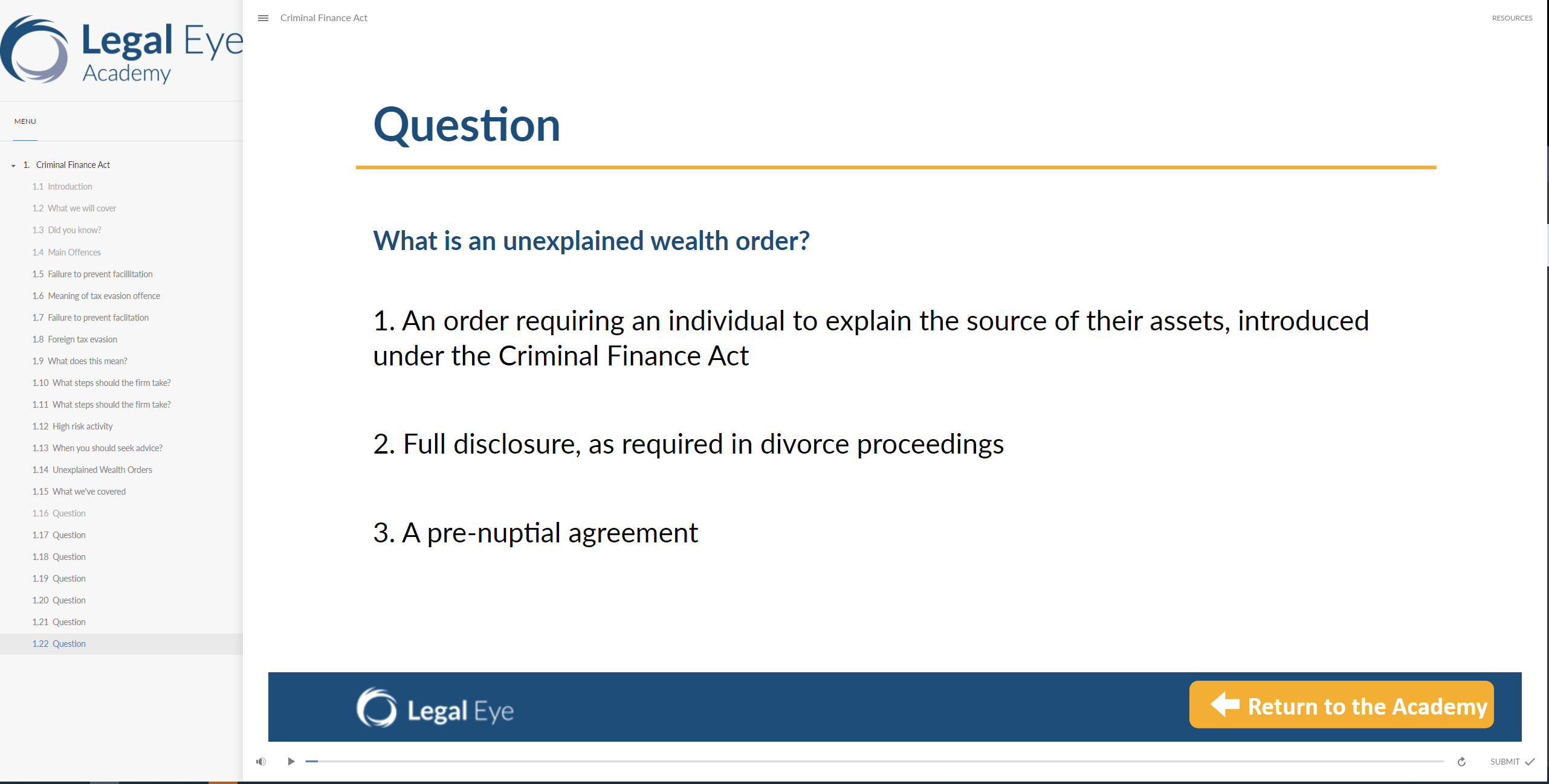

Our ‘Criminal Finance Act’ Academy module sets out the requirements under the Criminal Finances Act 2017 and includes:

- Background to the Act

- Main offences

- Requirements for procedures to prevent facilitation of tax evasion

- High risk factors

- When to seek advice

- Unexplained wealth orders

Online risk training designed specifically for law firms

The Academy is an online training platform which has been developed specifically for law firms. Covering the essential elements around preventing risk its topics are designed to ensure that all staff receive thorough and effective training.

More information

Don’t forget to look at our Resources tab for extra information as well as our Consultancy Services tab for information about our face to face AML training.

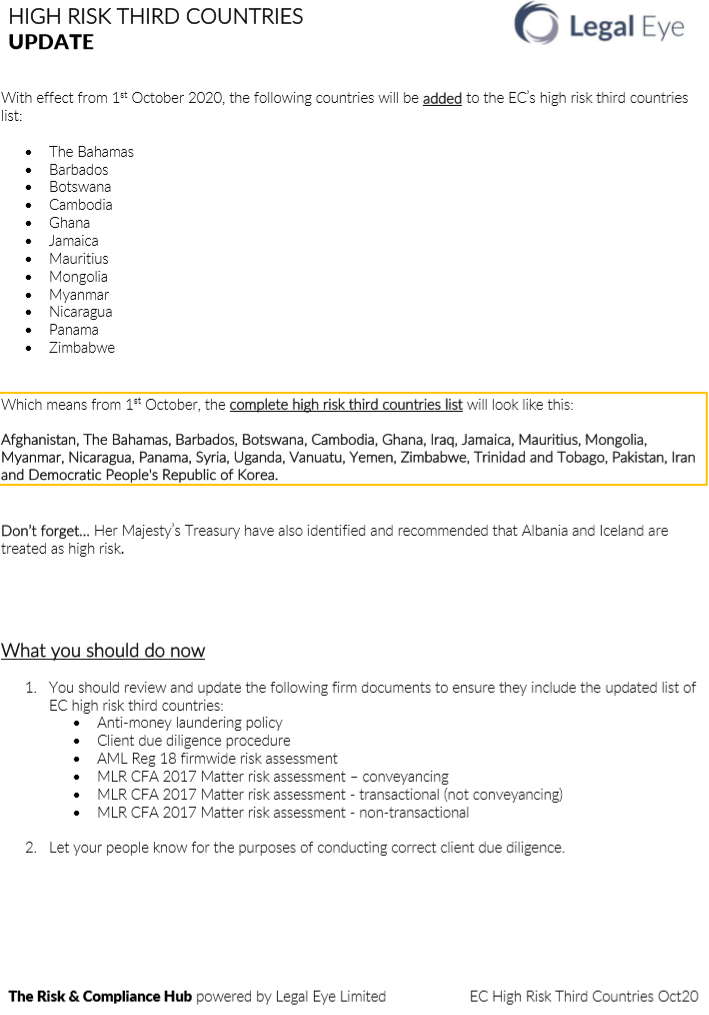

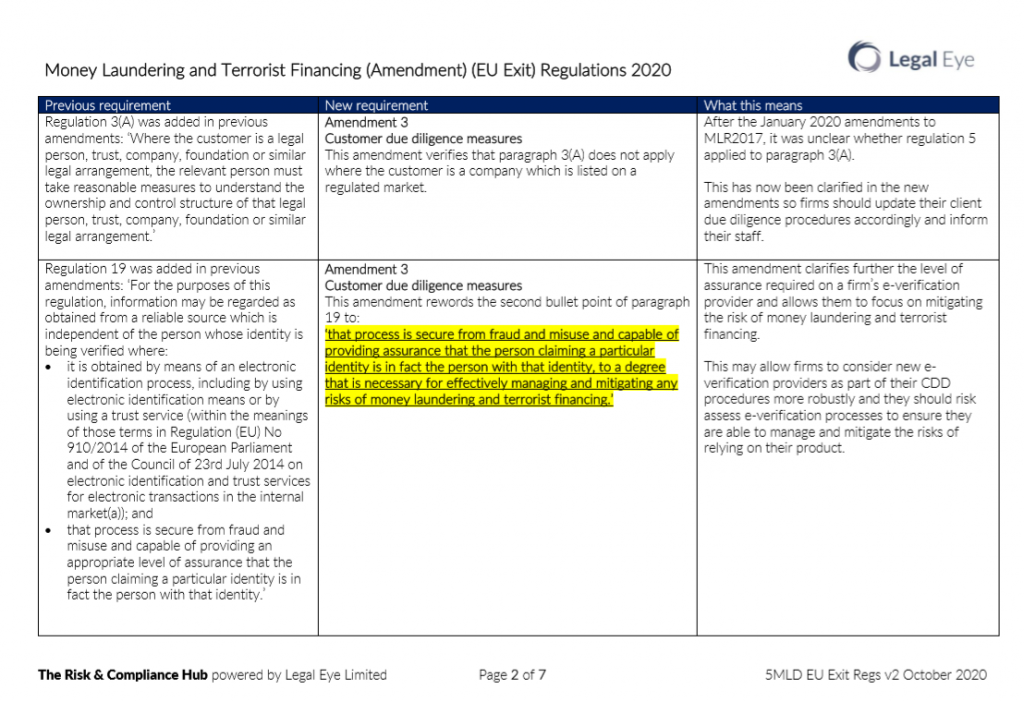

Use our financial crime templates to make sure your firm is up to date and compliant with the latest regulatory and legislative requirements. Our templates are regularly reviewed and updated as necessary when there is a change in regulation, legislation or best practice guidance. Look out for our New and Updated documents which are labelled below.

[table “19” not found /]Browse our selection of supplementary financial crime resources below – we add to these regularly and have lots of new resources currently in development which will be here soon.

***New Webinar*** Anti-Money Laundering update February 2021

Would EVERYONE in your firm spot a

‘red flag’ that would potentially alert you to an attempted crime or fraud?

When was the last time you REMINDED all your staff what they need to do in order to prevent money laundering and to document your firm’s actions to prevent the same?

Has everyone RECENTLY undergone refresher training specifically on AML? Would ALL STAFF pass a test if there was an AML quiz later today?

How would your regulator assess your AML defences if they called in tomorrow?

Work with a Legal Eye Associate who will provide sound knowledge and a selection of practical solutions for your firm to comply with ever-changing regulatory framework. Browse our paid-for consultancy services below and get in touch if you have any questions or require more information

(0)20 3051 2049

(0)20 3051 2049